How finance companies keep Jira projects audit-ready

Jira is used by finance teams, including insurance, banking, lending, and fintech, to handle numerous projects. These may include:

Loan approvals - reviewing documents, processing requests.

Claims management - examination of insurance claims and updates.

Fraud checks - inquiry of suspicious activity.

Compliance activities - proving that regulations are followed.

In every one of these projects, the changes must be fully visible. Clear records are essential because they help auditors and regulators ensure that it is all transparent and compliant.

🎯 Goals

Finance teams using Jira need to:

Keep audit trails complete for every project.

Make sure regulators and auditors get the reports they require.

Improve transparency, so everyone knows who made which change.

Reduce manual work when preparing compliance documents.

Build trust with stakeholders by showing clear accountability.

⚠️Problems

Jira’s built-in history is not enough for finance companies’ needs:

The changes are difficult to export and share with auditors.

Deleted updates (such as comments) are gone permanently.

It is too time-consuming to check a lot of work items.

This makes audits and reporting stressful and slow.

💡 Solution

Issue History for Jira app provides a clear and reliable way for finance companies to track all changes in their projects in Jira:

It displays a full history of updates in a single table.

Changes can be filtered by project, assignee, or time period.

Auditors can get reports instantly in CSV, Excel, or PDF formats.

All activities are connected to the initiator of the change, which helps in accountability.

The app has already gained significant popularity among mid-size and large finance companies, who use it to keep compliance projects, loan approvals, and claims management audit-ready.

This way, finance teams can ensure complete transparency and reduce manual work when preparing for audits.

🔄 Workflow

The following are potential situations where finance companies use Issue History for Jira app.

1. Loan Approval

Use case: A bank can monitor every action of a loan application.

The way Issue History for Jira app can be used:

Compliance officers can filter work items in Jira by status change to see the entire timeline of a loan.

They export an Excel report to share with regulators.

.png?inst-v=72f9cf44-ed5a-48e3-abf6-ce78879dd617)

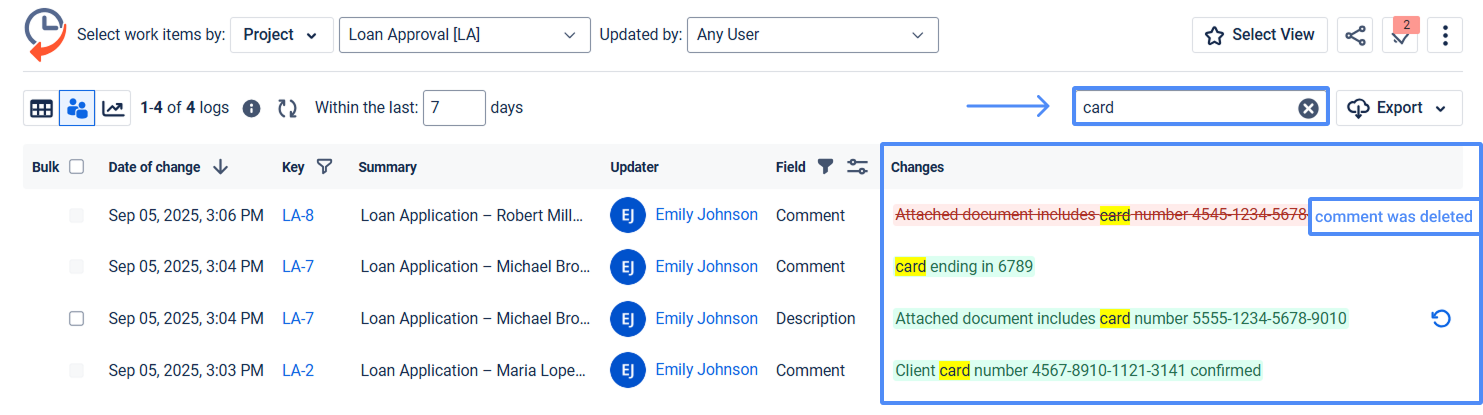

2. Sensitive Data Revealing

Use case: The compliance department of a bank should ensure that all sensitive information (such as credit cards or Social Security numbers) about the client is not present in the description or comments of Jira work items. In some cases, employees may accidentally paste a client's card number in a task. This poses compliance risks.

The way Issue History for Jira app can be used:

Compliance officers can use the search functionality in Issue History for Jira app to look for patterns such as: ####-####-####-#### (credit card format) or such words as “card number”, “PAN”, “SSN”.

The sensitive data can be found instantly in all places where they occurred.

The app shows the person who added that info, the date, and whether it was removed or not.

Then, such a report can be exported and forwarded to the data security team.

With Issue History for Jira app, our clients in the finance sector can save time on audits, reduce risks, and ensure every Jira project is fully accountable.